In this post, you will learn about how to apply pan card online. But before that, first you’ll learn What is a PAN card and why is it important in India?

What is a PAN card?

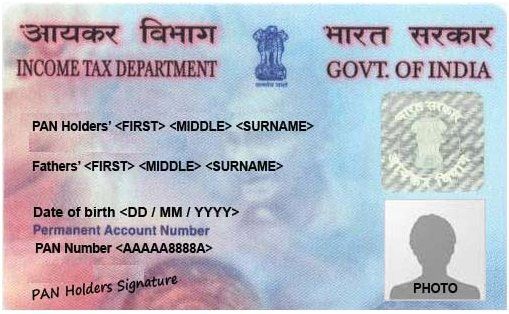

PAN card is an abbreviation for Permanent Account Number, is a 10 digit alphanumeric number issued in the form of a plastic card, by Income Tax Department of India.

It enables the income tax department of India to track all the financial transaction records of the person, in any form i.e., either by cash, cheque or any type of digital transaction etc.

Format of PAN number

A typical PAN number is BUOPA7734K.

The format of the PAN number is:

- First three characters in a PAN number are alphabetical series between AAA to ZZZ.

-

The fourth character of PAN represents the status of the PAN holder i.e.,

-

“P” stands for Individual.

-

“F” stands for Firm.

-

“C” stands for Company.

-

“H” stands for HUF.

-

“A” stands for AOP.

-

“T” stands for TRUST etc.

-

- The fifth character in the PAN represents the first letter of the last name/surname of the owner.

- Next four characters are the number range from 0001 to 9999.

- The last character in the PAN is an alphabetic check digit.

What is the use of pan card?

It is mandatory to provide PAN while filing an Income Tax Return. It is also compulsory to provide PAN in all documents pertaining following transactions:

- Sale or purchase of any immovable property valued at rupees 5 lakhs or more.

- Sale or purchase of any motor vehicle (excluding 2 wheels vehicle).

- Depositing money exceeding ₹ 50,000 in any bank, post office savings account.

- A contract of a value exceeding one lakh rupees for sale or purchase of securities.

- Opening a bank account.

- Payments of hotels/restaurant bills exceeding the amount of ₹ 25,000.

- Installation of telephone line.

-

Payment in cash for the purchase of bank drafts or pay orders or banker’s cheques for an amount more than ₹ 50,000 or more during any one day.

- Payment in cash in connection with travel to any foreign country of an amount ₹ 25,000 or more any one day.

How to apply PAN card online?

You can apply PAN card online in 5 easy steps:

- Collect a copy of the document(s) required for Proof of Identity, Proof of Address and Proof of Date of Birth which includes Aadhar Card, Voter’s ID, Passport, Driving License etc. View all applicable PAN documents list.

- Fill up the form 49A with all the correct information.

- Pay ₹ 110 online with your Internet Banking or Credit/Debit/Rupay/Visa/Master card.

- Download and save the form and take out a print out. Affix two (same) photographs of 3.5cms X 2.5cms size. And put 3 signatures at required places (see in the image below).

- Attach the above-collected documents with the form and send it at any one PAN card office located in Delhi, Mumbai, Chennai on Kolkata (address given at the end of the article).

Below I have explained all the steps in detail with images for better understanding:

Step 1: Documents collection

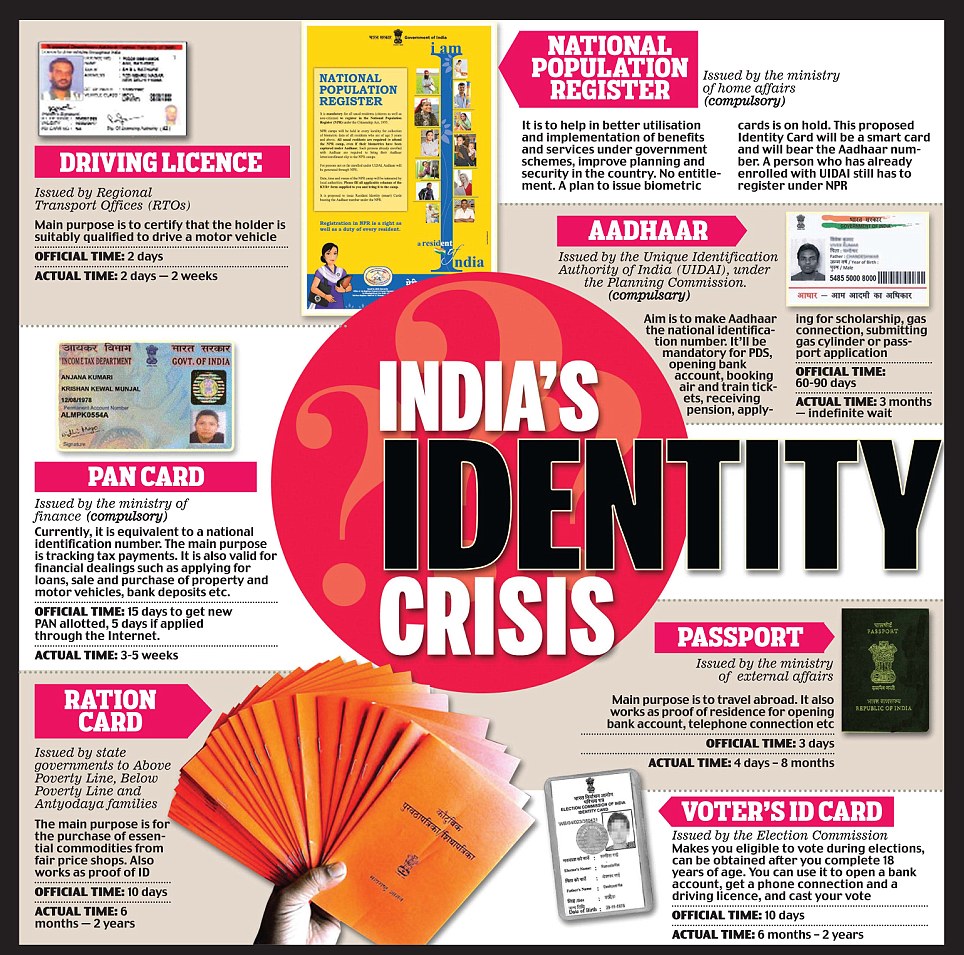

Collect a copy of any document which can be used as proof of Identity (full name, father’s name, photograph), proof of address and proof of date of birth. Aadhar card, Voter’s ID card, Passport, Driving License would be enough for all these. View all applicable PAN documents list.

(image source: dailymail.co.uk)

(image source: dailymail.co.uk)

Step 2: Fill form 49A online

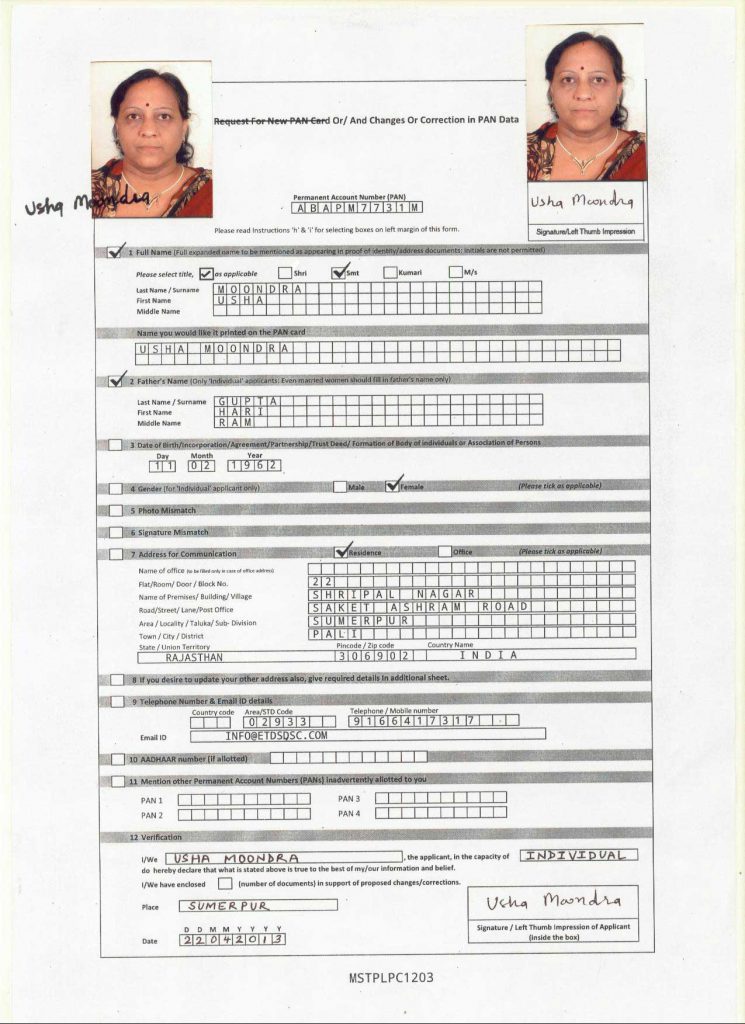

Fill form 49A correctly. It is the most crucial and time taking part of the process. You must have to fill in all information correctly and should cross check all the inputs before submiting the form. To avoid mistakes, please refer Guidelines and Instructions

Step 3: Payment

After you have filled in all the information correctly cross check all the fields/inputs, then click on submit and you’ll be taken to a payment gateway page to pay Rs. 110/- (may change)

You need to carry out the payment attempt using one of the following options: Netbanking, Credit Card (Master/Visa), Debit Card (Master/Visa), Cash Card or any other as seen available on the Payment Gateway site.

Step 4: Download and Save form

After successful payment, download and save the form to you computer. Take the print-out of the form and affix 2 passport size photographs (3.5cms X 2.5cms).

After affixing both the photos, you should sign at the 3 specified positions on this photo-affixed form as follows:

- On the left hand box, sign across the affixed photograph.

- On the right hand box, sign below the photo in the space provided.

- On page 2 of the form, sign in the bottom right hand box in the space provided.

(image source: pancard.org.in)

(image source: pancard.org.in)

Step 5: Send the hard copy.

Attach the copy of collected the document(s) in step 1 with the print-out of form 49A, and send it to any one of the following PAN card offices of India by post or registry.

Plot No. 3, Sector 11, CBD Belapur

NAVI MUMBAI – 400614

Tel No: (022) 67931300

UTI Infrastructure Technology And Services Limited

1/28 Sunlight Building, Asaf Ali Road,

NEW DELHI -110002

Tel No: (011) 23211262/23211273-23211274

UTI Infrastructure Technology And Services Limited

29, N. S. Road, Ground Floor,

Opp. Gilander House and Standard Chartered Bank,

KOLKATA – 700001

Tel No: (033) 22108959 / 22424774

Guindy,

CHENNAI – 600032

Tel No: 044-22500426/044-22500183

After completing all the above steps, it will take 3 to 5 weeks for Income Tax Department to issue a PAN card, and it will be sent at the residential address provided by you in the form.

How to do PAN card status check?

After you apply PAN card online and send it by post to any of the registered offices in India, you can check the PAN card status online at UTI and NSDL website. PAN card status check can be done by 2 means:

- Track PAN card status by name and date of birth

- Track PAN card status by ACKNOWLEDGEMENT NUMBER

Track PAN card status by name and date of birth

Visit NSDL website, select Application Type as a PAN from the drop-down list. And select “Name”, from the radio button. Put Last name/Surname, First Name and Middle Name, after that put your Date of Birth. Fill out the Captcha and press submit button.

Track PAN card status by Acknowledgement Number

Checking PAN card status by Acknowledgement Number is similar to checking PAN card status by name and date of birth. Follow the above options, just select the acknowledgement number type in radio button.

Thanks for sharing knowledge with us.

keep sharing…

is that we need to link our PAN card with our bank account

Yes, it is necessary