With the rapid development of technology, especially along with the Internet, online commerce has

become a norm. Nowadays, we can buy a vast variety of things and services online, from groceries,

electronics to clothing. And we can pay our electricity bills, loan repayments, insurance premium, and

many more.

However, online payments include a lot of complexities that are hidden beneath. Moreover, any weak point in the payment processing system is a gateway to fraudsters.

The fraudsters are always looking out for chances to exploit. And the stats support it too. Search online, and you can find that every year unbelievable amounts of money is lost due to fraud.

Plus, the data breaches add salt to the wound. Often, data breaches involve the theft of personal information of users and their credit card details.

So, if you are an online merchant or an eCommerce vendor, ensure the following steps and procedures so that you and your customers are away from harm’s way.

SSL Certificates

For your online payment processing, ensure that all the URLs are secured with SSL certificates. Implementing SSL Certificate on the website, one can migrate to HTTPS which is the secured version of HTTP.

If you are using a payment aggregator like PayPal or Stripe, make sure that you are redirecting your users to the payment pages with proper security. Leaving any weak points might jeopardize the customer/buyer identity, and it will later lead to a problematic situation.

There are many types of SSL certificates available. It depends on your needs on how your payment processing system is implemented.

Wildcard SSL certificates are required if you have multiple subdomains under the same domain name. And you should buy Multi-Domain SSL certificates if you are running your site using various domains.

While opting free SSL certificates might seem attractive, they do not come with proper warranties and customer support. It would help if you did not take any chances and buy SSL certificates that come with a warranty and excellent technical support.

PCI DSS Compliance

PCI DSS stands for Payment Card Industry Data Security Standard. And It is a global standard.

PCI DSS is a standard for payment processors, aggregators as well as card issuers. In common, PCI DSS compliance applies to any organization that handles branded card payments. The standard has specific security measures in place so that the risk of fraud is kept to a minimum.

You should adhere to PCI DSS compliance when handling online payments. Or, If you are using a payment gateway, ensure that PCI DSS compliance in place. Otherwise, you might run into troubles.

Anyhow, if you are not following PCI DSS standards, payment networks like Visa, Mastercard will not process customer payments. And they might even abstain you from using their services.

Tokenization

If you are selling subscriptions or a software-as-a-service, it is not uncommon that you have to set up recurring payments with customer credit cards. This often requires you to store user’s credit card details. Encrypting and storing these details is not enough. Because, when your encryption keys are compromised, the customer data also gets compromised.

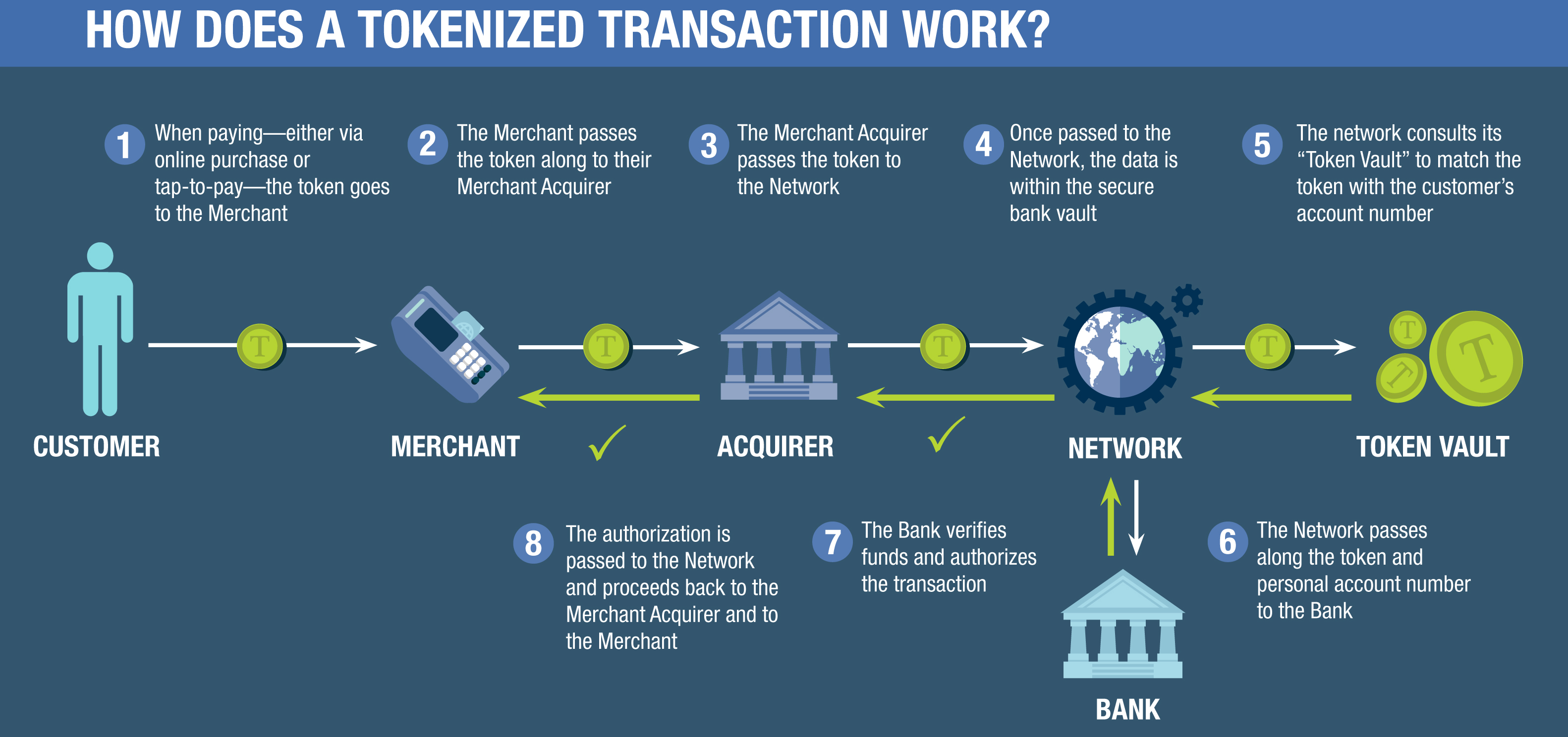

But you can use tokenization for better security. Here, a tokenization system will be in place. With the help of the system, instead of storing the credit card details, you save a random number or a string pertaining to the sensitive credit card information. With the Tokenization system, you can refer to the sensitive data with authentication.

That way when a data breach occurs, the token information becomes useless as the hacker will not have details on how to access the sensitive data.

However, implementation of the Tokenization system should be strategical so that it is isolated from the data processing systems. Moreover, the tokenization system should be the only entity that can issues tokens and gives access to data in the tokenization process.

3D Secure Authentication

In addition to entering card details, during the payment, the customer will be asked for an additional password. This password will be given as an OTP (One Time Password) when the cardholder is transacting, or as a pre-set pin, by the card issuing bank. And the process is called 3D Secure.

Enabling 3D secure authentication also allows you to block fraudsters from transacting on your site.

This additional layer of protection ensures more security for the payment process.

Keep Your Software Updated

If you are running on a managed service like Shopify, all the necessary updates will be taken care of by the Shopify itself.

Else, if you are running your own servers, ensure that you are keeping your operating system (OS), middleware, and all other components like Database Management System (DBMS) up to date. Often these updates either include security patches or performance improvements. So, keeping your software components up to date is so important.

Conclusion

Online fraud is something hard to eradicate. With various technological innovations, fraudsters are also keeping themselves up to date and are eying for chances to break in. However, if you add more layers of security, the bad actors would turn away from you.

That said, every payment process is different to some extent. In addition to the above explained, you should take some additional measures.

Anyhow, not protecting your payment process on par with industry standards will be become an impediment to your customer success management; as it makes your users/customers feel less confident about your services.

If you are starting small and finding it time-consuming to secure your payment process, then turning to managed services—that come along with a built-in payment processing system is a good option.

Leave a Comment